A bank statement sample is a replica of a real bank statement, showcasing transactions, balances, and account details. It helps users understand financial records and verify authenticity. Redacting sensitive information ensures security when sharing. These samples are essential for financial planning and verification purposes.

1.1 Overview of Bank Statements

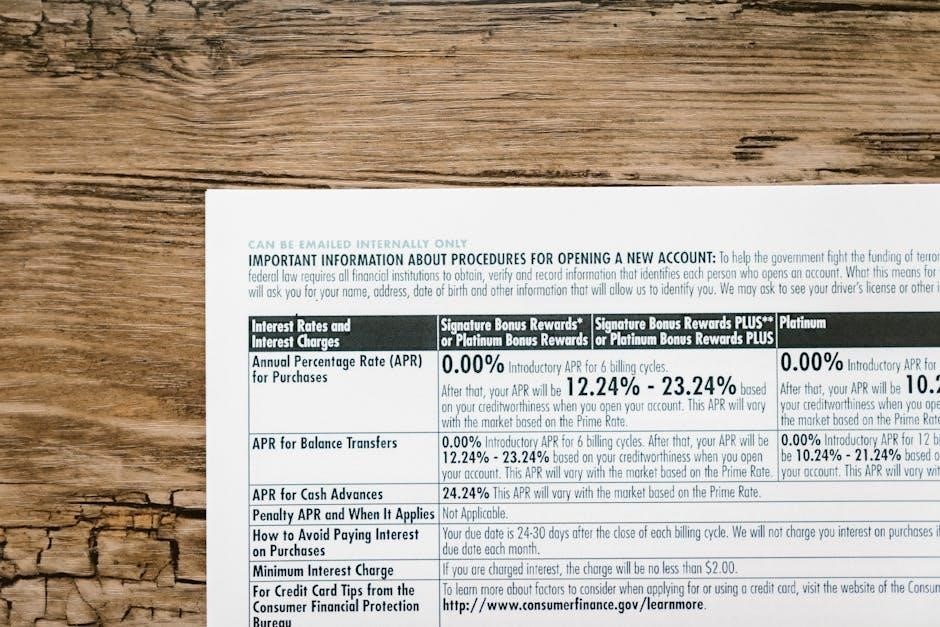

A bank statement provides a detailed record of all transactions, including deposits, withdrawals, and fees, over a specific period. It typically includes the account holder’s name, account number, transaction dates, descriptions, and running balances. Statements are essential for tracking financial activity, verifying account accuracy, and managing personal or business finances effectively.

1.2 Importance of Bank Statement Samples

Bank statement samples are crucial for understanding financial records, verifying transactions, and ensuring accuracy. They provide a template for redacting sensitive information, protecting privacy when sharing documents. Samples also aid in financial planning, helping users track spending and manage budgets effectively. They are invaluable for both personal and professional financial management.

Structure of a Bank Statement

A bank statement typically includes account details, transaction history, and balance summaries. It provides a clear overview of financial activities, making it essential for tracking and managing finances effectively.

2.1 Key Sections of a Bank Statement

A bank statement includes key sections such as account holder information, transaction details, and balance summaries. It also lists dates, transaction amounts, and descriptions, providing a comprehensive overview of financial activities. Redacting sensitive details ensures privacy and security when sharing statements for verification or other purposes.

2.2 Transaction Details and Descriptions

Transaction details in a bank statement include dates, amounts, and descriptions of each entry, helping users track income and expenses. Descriptions specify transaction types, such as deposits, withdrawals, or transfers. Redacting sensitive info like payee names protects privacy when sharing statements for verification or financial planning purposes online.

2.3 Account Balance and Summary

A bank statement includes the account balance, showing the beginning balance, transactions, and ending balance. This summary helps users track their financial status and ensure accuracy. Regularly reviewing balances aids in detecting discrepancies and supports effective financial planning and budgeting.

How to Obtain a Bank Statement

Access bank statements via online banking, download them as PDFs, or request paper copies. Ensure secure access and verification to protect sensitive financial information effectively always.

3.1 Accessing Statements via Online Banking

Accessing bank statements via online banking is convenient and secure. Log in to your account, navigate to the statements section, and select the desired period. Statements are typically available in PDF format for easy downloading. Ensure your device and connection are secure to protect sensitive information during the process.

3.2 Downloading Statements in PDF Format

Downloading bank statements in PDF format is straightforward. Select the desired date range, choose the PDF option, and save the file. PDFs are ideal for readability and security. Ensure your device is secure before downloading. Consider redacting sensitive details before sharing to protect your personal and financial information.

3.3 Requesting Paper or Digital Copies

To obtain bank statement copies, visit your bank’s website or mobile app and navigate to the statements section. Select the desired period and choose either digital download or paper delivery. Ensure sensitive details like account numbers are redacted before sharing. Always verify the accuracy of transactions and store copies securely.

Security and Privacy in Bank Statements

Bank statements contain sensitive personal and financial information, making them targets for fraud. Redacting details like account numbers and addresses is crucial to protect against identity theft and unauthorized access.

4.1 Sensitive Information in Bank Statements

Bank statements often include sensitive details such as account numbers, addresses, transaction amounts, and recipient information. This data can be exploited by fraudsters if not properly secured. Redacting these elements is essential to prevent identity theft and financial fraud when sharing statements with third parties or online platforms.

4.2 Redacting Sensitive Details for Sharing

Redacting sensitive details in bank statements ensures personal and financial information remains confidential. This includes blacking out names, addresses, account numbers, and transaction specifics. Redaction tools or manual methods can be used to remove or obscure sensitive data, making it safe to share statements without risking identity theft or fraud.

4.3 Protecting Statements from Fraudsters

Protecting bank statements from fraudsters is crucial, as they contain sensitive information like names, addresses, and account details. Use encryption for digital storage and secure platforms for sharing. Regularly monitor transactions for unauthorized activity and verify the authenticity of requests before sharing statements to prevent identity theft and financial fraud.

Redacting Bank Statements

Redacting bank statements involves securely removing sensitive information like account numbers, transactions, and personal details to protect privacy. This ensures confidentiality when sharing documents for verification or financial purposes.

5.1 Why Redaction is Necessary

Redaction is essential to protect sensitive information in bank statements, such as account numbers, transaction details, and personal data, from unauthorized access. It prevents fraud, identity theft, and misuse of financial data when sharing documents with third parties or submitting them for verification purposes.

5.2 Tools and Methods for Redaction

Redaction tools like Adobe Acrobat and online PDF editors enable secure blacking out of sensitive information. Manual redaction using black markers is also effective for physical copies. These methods ensure personal and financial data remain protected when sharing bank statement samples.

5.3 Best Practices for Secure Sharing

Always redact sensitive information before sharing. Use encrypted email or secure online portals for transmission. Verify recipient identity and ensure confidentiality agreements are in place. Avoid sharing via unsecured platforms and consider adding watermarks. Inform recipients about security measures to maintain data protection and privacy.

Formatting and Customization

Bank statements can be customized using templates to match specific needs. Ensure compliance with bank policies when modifying formats. Adding notes or watermarks enhances clarity and security.

6.1 Customizing Bank Statement Templates

Customizing bank statement templates allows users to tailor financial documents to specific needs, ensuring clarity and professionalism. This process often involves redacting sensitive information, adjusting layouts, and adding institutional branding. Tools like PDF editors facilitate these changes, enabling users to create polished, secure statements that meet organizational standards and compliance requirements effectively.

6.2 Ensuring Compliance with Bank Policies

Ensuring compliance with bank policies when handling bank statement samples is crucial. This involves redacting sensitive information, adhering to formatting standards, and following specific guidelines to protect data integrity. Tools like PDF editors help maintain compliance by enabling secure redaction and proper formatting. Non-compliance can lead to legal consequences and security breaches, compromising financial security.

6.3 Adding Additional Information or Notes

Adding extra details to a bank statement PDF can enhance clarity and context. Use PDF editors to insert notes or explanations without altering the original data. Ensure notes are placed discreetly, avoiding sensitive areas. Maintain consistency and avoid including confidential information to preserve document integrity and security.

Common Mistakes to Avoid

Common errors include incomplete redaction, missing transaction details, and improper formatting. Ensure all sensitive information is securely blacked out and verify accuracy before sharing or submitting statements.

7.1 Incorrect or Missing Information

Incorrect or missing information on bank statements can lead to fraud risks, processing delays, or financial discrepancies. Always ensure transactions are accurate and complete. Redact sensitive details like account numbers and balances before sharing. Regularly review statements to detect errors or unauthorized transactions early and prevent financial harm.

7.2 Not Reviewing Transactions Regularly

Not reviewing transactions regularly can lead to unnoticed fraudulent activities or errors. Overlooking unauthorized charges or discrepancies may result in financial loss. Regular checks ensure accuracy and security, helping to identify and address issues promptly. Redacting sensitive details before sharing adds an extra layer of protection against potential fraudsters.

7.3 Improper Storage of Statements

Improperly storing bank statements can expose sensitive information to fraudsters. Failing to secure physical or digital copies increases the risk of unauthorized access. Always store statements in a safe, locked location or use encrypted digital storage. Redacting sensitive details before storage adds an extra layer of protection against potential fraud.

Legal and Compliance Considerations

Bank statements must comply with data protection laws to ensure privacy and security. Redacting sensitive information is crucial to avoid legal violations. Non-compliance can lead to penalties and reputational damage, emphasizing the importance of proper handling and storage of financial documents.

8.1 Data Protection Laws and Bank Statements

Data protection laws require banks to safeguard sensitive information in statements. Redacting personal details ensures compliance and prevents identity theft. Failure to adhere to these regulations can result in legal penalties and loss of customer trust, emphasizing the importance of secure handling and storage of financial documents.

8.2 Requirements for Submitting Statements

Submitting bank statements often requires redacting sensitive information like account numbers and balances. Ensure accuracy and relevance to the request. Companies may demand statements to verify salary deposits or financial stability. Always comply with data protection laws and redact personal details to maintain privacy and security when sharing financial documents.

8.3 Consequences of Mishandling Statements

Mishandling bank statements can lead to severe consequences, including identity theft, financial fraud, and legal repercussions. Sensitive information exposure may result in privacy breaches and reputational damage. Ensuring secure handling and redaction is crucial to protect individuals and organizations from potential harm and financial loss.

Tools and Software for Managing Statements

Utilize PDF editors for redaction, financial software for transaction analysis, and online platforms for secure sharing. These tools enhance efficiency and security in managing bank statements effectively.

9.1 PDF Editors for Redaction and Editing

Use PDF editors like Adobe Acrobat or online tools for secure redaction and editing. These tools allow you to blackout sensitive details, add passwords, and convert bank statements to PDF. They ensure privacy and protect personal information when sharing financial documents digitally.

9.2 Financial Software for Transaction Analysis

Financial software like Google Sheets and Excel are essential for analyzing bank statements. These tools enable categorization of transactions, generation of reports, and insights into spending patterns. They help in organizing financial data securely, making it easier to manage expenses and track income effectively.

9.3 Online Platforms for Secure Sharing

Secure online platforms like encrypted email services and cloud storage solutions ensure safe sharing of bank statements. Tools such as Google Sheets and encrypted file-sharing platforms offer advanced security features to protect sensitive financial data. These platforms enable users to share redacted statements confidently, maintaining privacy and compliance with data protection standards.

Best Practices for Using Bank Statement Samples

Always verify the authenticity and accuracy of bank statement samples. Use redacted versions for sharing and ensure compliance with privacy laws. Regular reviews and proper storage are essential for security and fraud prevention.

10.1 Verifying Authenticity and Accuracy

Verifying the authenticity and accuracy of bank statement samples is crucial. Cross-check transactions, balances, and dates with original records. Ensure all details match and are free from alterations. Redacted samples should retain essential information while protecting sensitive data. Regular audits and digital tools can help maintain accuracy and detect discrepancies promptly.

10.2 Using Samples for Financial Planning

Bank statement samples are valuable tools for financial planning. They provide a clear overview of income and expenses, helping identify spending patterns and areas for cost reduction. By analyzing transaction trends, individuals can set realistic budgets, track savings progress, and make informed decisions to achieve long-term financial goals effectively.

10.3 Educating Others on Statement Usage

Educating others on using bank statements involves teaching them to identify transactions, track spending, and verify account balances. Sharing samples helps individuals understand financial records and improve their budgeting skills. Emphasize the importance of redacting sensitive details before sharing to ensure privacy and security.

Understanding bank statements is crucial for financial management. Samples provide clear examples for education and verification. Regular reviews help maintain accuracy and security, ensuring informed decisions.

11.1 Summary of Key Takeaways

Bank statement samples are essential for understanding financial records, ensuring accuracy, and maintaining security. Redacting sensitive details protects privacy, while regular reviews help detect discrepancies. Using samples for planning and education ensures informed decision-making and compliance with financial policies.

11.2 Final Tips for Effective Use

Always redact sensitive details before sharing to protect privacy. Use PDF editors for secure redaction and ensure compliance with bank policies. Regularly review statements for accuracy and store them securely. Share only necessary information and educate others on best practices for handling bank statement samples responsibly.

11.3 Encouragement for Regular Review

Regularly reviewing bank statements helps detect errors, unauthorized transactions, and fraud early. Use online banking or financial software to monitor accounts frequently. Redact sensitive details before sharing and store statements securely. Consistent reviews ensure financial accuracy and security, promoting better money management and peace of mind for account holders.